Do you pay more interest the longer the term loan?

In general, the longer your loan term, the more interest you will pay. Loans with shorter terms usually have lower interest costs but higher monthly payments than loans with longer terms.

You'll likely have to pay a higher interest rate.

A longer term is riskier for the lender because there's more of a chance interest rates will change dramatically during that time. There's also more of a chance something will go wrong and you won't pay the loan back.

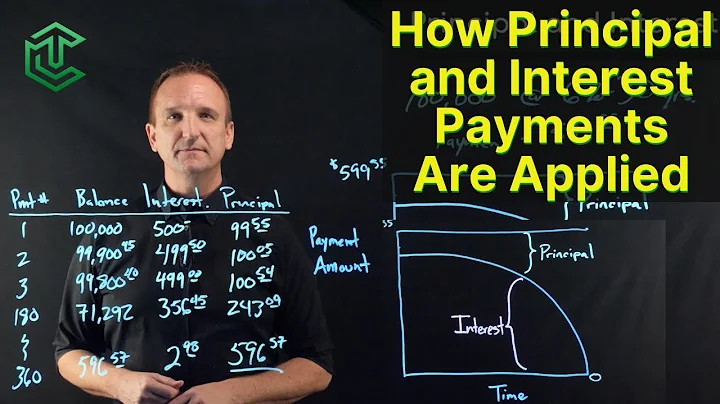

Since lenders charge interest payments monthly, a longer loan term inherently means more interest payments. Taking on a personal loan with a shorter term will help you save on interest charges (at the trade-off of having larger monthly payments, of course).

Another difference is that long-term interest rates are usually higher than short-term interest rates. For example, your bank will charge you a lower interest rate on a $10,000 loan that you pay back within six months than on the same $10,000 loan but paid back in five years.

In general, short-term loans have interest rates that are higher than long-term loans. Calculating the cost of a short-term loan in comparison to a long-term loan with a lower interest rate is advisable.

This is because longer-term bonds have a greater duration than short-term bonds that are closer to maturity and have fewer coupon payments remaining. Long-term bonds are also exposed to a greater probability that interest rates will change over their remaining duration.

The hidden cost of a longer term

Taking longer to pay down your loan means you're also paying interest for longer. And while your repayments can decrease, the long-term interest cost can skyrocket. Stretching a $500,000 loan from 25 to 30 years could mean paying a whopping $128,000 more in total interest.

Cons of longer repayment term business loans

The extended repayment period means the loan accrues interest over a longer duration, leading to a higher overall cost to borrow compared to short-term loans. Carefully assess whether the benefits of lower monthly payments outweigh the higher costs of interest expenses.

Long-term loans have longer repayment periods — which means they may be helpful in getting your debt under control with smaller monthly payments. The big downside is that it can keep you in debt that much longer.

Limits Company's Exposure to Interest Rate Risk – Long-term, fixed-rate financing minimizes the refinancing risk that comes with shorter-term debt maturities, due to its fixed interest rate, thus decreasing a company's interest rate and balance sheet risk.

Are longer-term loans riskier?

Long-term loans tend to carry less risk for the borrower, but interest rates tend to be at least slightly higher than for short-term loans. Long-term financing is typically used to cover equipment purchases, vehicles, facilities, and other assets with a relatively long useful life.

The longer you have to pay off a loan, the smaller your monthly payments will be. This is because the total amount you borrowed can be divided up into a greater number of instalments. Long-term loans often have lower interest rates.

On the one hand, you save money on accruing interest when you pay off a debt early, and your debt-to-income ratio will go down. However, some lenders charge a prepayment penalty for early payments, and using your spare income to pay off your loan early means it won't be available for other expenses.

The longer the term, the lower your monthly payments will be, but you'll pay more in interest over time. Fees are charges associated with taking out and repayment of a long-term loan. These can include origination fees, closing costs, and prepayment penalties.

These loans are considered less risky compared to long term loans because of a shorter maturity date. The borrower's ability to repay a loan is less likely to change significantly over a short frame of time. Thus, the time it takes for a lender underwriting to process the loan is shorter.

The advantages of debt financing include lower interest rates, tax deductibility, and flexible repayment terms. The disadvantages of debt financing include the potential for personal liability, higher interest rates, and the need to collateralize the loan.

Since long-term loans are paid back over a longer period, banks and other lenders charge less interest on these loans. Because of this, rates for car loans and home loans are lower than rates for personal loans.

Basic Info. Japan Long-Term Interest Rates is at 0.73%, compared to 0.62% last month and 0.49% last year. This is lower than the long term average of 1.84%.

US Long-Term Interest Rates is at 3.87%, compared to 4.06% last month and 3.75% last year. This is lower than the long term average of 4.49%. US Long Term Interest Rates is a data point released by Robert Shiller.

The more on-time payments you make, the greater the postive impact on your credit score. We recommend taking out the longer term loan which provides a lower payment, thus giving you financial flexibility should other unexpected expenses arise.

What are the risks of long term finance?

There are many types of risks associated with long term debt financing. The most common are interest rate risk, credit risk, and liquidity risk. Interest Rate Risk: Interest rate risk is the risk that interest rates will rise, causing the value of your investment to fall.

Long-term loans provide lower interest rates because of the amounts included and the extended repayment tenure. The interest rate is generally influenced by the loan amount, income source, tenure, and credit history of the individual. When the loan amount increases, the rate of interest can be reduced significantly.

"In many cases, paying off a personal loan early will save the borrower money in interest," says Thomas Nitzsche, senior director of media and brand at Money Management International, a nonprofit credit counseling agency. With loan payments out of the way, you free up money to pad your monthly budget.

Make bi-weekly payments

Instead of making monthly payments toward your loan, submit half-payments every two weeks. The benefits to this approach are two-fold: Your payments will be applied more often, so less interest can accrue.

Paying off a loan early could save you money in the long term as it can reduce the total amount you need to repay. Bear in mind that you need to account for any early repayment charges to help decide if it's the right choice for you.