Why is having debt bad for the economy?

If a country's

A nation saddled with debt will have less to invest in its own future. Rising debt means fewer economic opportunities for Americans. Rising debt reduces business investment and slows economic growth. It also increases expectations of higher rates of inflation and erosion of confidence in the U.S. dollar.

For example, rising government debt in an economy without excess labor and capacity may fund additional consumption (through welfare payments, for instance), be poured into defense spending, or go toward nonproductive investment in wasted infrastructure (a particular problem in China); ballooning debt could also ...

Having too much debt can make it difficult to save and put additional strain on your budget. Consider the total costs before you borrow—and not just the monthly payment. It might sound strange, but not all debt is "bad." Certain types of debt can actually provide opportunities to improve your financial future.

If countries default on their debts, it can cause panic on financial markets and economic slowdowns. For businesses, meeting repayments on high levels of debt can mean less money is available to invest in jobs and expansion. Insolvency is also a risk for businesses that are unable to pay back their loans.

High sovereign debt levels are associated with slower economic growth and rising default risk. Government borrowers able to issue bonds in their own country's currency are less likely to default.

It will push up interest payments and slow economic growth by crowding out private investment and public spending that could otherwise be used to improve America's workforce, infrastructure, and productive capacity.

Debt is an important, if not essential, tool in today's economy. Businesses take on debt in order to fund needed projects, while consumers may use it to buy a home or finance a college education. At the same time, debt can be risky, especially for companies or individuals that accumulate too much of it.

The worries of debt and persistent creditor contact can also result in stress, which if left untreated, can cause further problems such as difficulty sleeping, extreme anxiety, muscle tension, chest pain and irritability.

- The need for regular income. The repayment of debt can become a struggle for some business owners. ...

- Adverse impact on credit ratings. If borrowers lack a solid plan to pay back their debt, they face the consequences. ...

- Potential bankruptcy.

Why is debt important to the economy?

The national debt enables the federal government to pay for important programs and services even if it does not have funds immediately available, often due to a decrease in revenue. Decreases in federal revenue coupled with increased government spending further increases the deficit.

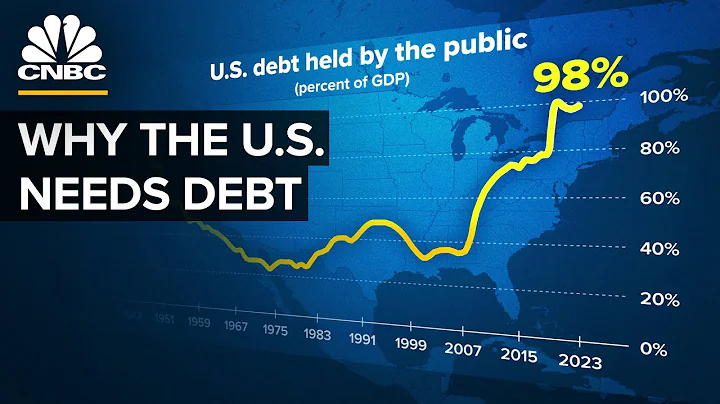

Economists measure the severity of a nation's debt based on its debt-to-GDP ratio. The U.S. debt held by the public is nearly at 100%. The Committee for Economic Develop of the Conference Board says a responsible debt-to-GDP ratio for a country the size of the U.S. would be 70%.

At high debt levels, governments have less capacity to provide support for ailing banks, and if they do, sovereign borrowing costs may rise further. At the same time, the more banks hold of their countries' sovereign debt, the more exposed their balance sheet is to the sovereign's fiscal fragility.

Growing debt also directly affects the economic opportunities available to every American. If high levels of debt crowd out private investments in capital goods, workers would have less to use in their jobs, which would translate to lower productivity and, therefore, lower wages.

"Good debt" can help you increase your net worth over time or generate future income. "Bad debt" does not help your net worth increase or generate future income, and may have a high interest rate.

Now that we've defined debt-to-income ratio, let's figure out what yours means. Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high. The biggest piece of your DTI ratio pie is bound to be your monthly mortgage payment.

Around 70% of Japanese government bonds are purchased by the Bank of Japan, and much of the remainder is purchased by Japanese banks and trust funds, which largely insulates the prices and yields of such bonds from the effects of the global bond market and reduces their sensitivity to credit rating changes.

It began rising at a fast rate in the 1980's and was accelerated through events like the Iraq Wars and the 2008 Great Recession. Most recently, the debt made another big jump thanks to the pandemic with the federal government spending significantly more than it took in to keep the country running.

As people pay more of their income to debt, they have less money to purchase other items. Because consumer spending accounts for 70% of U.S GDP, too much pullback can tip the economy into a recession.

- Japan. $1,098.2. 14.52%

- China. $769.6. 10.17%

- United Kingdom. $693. 9.16%

- Luxembourg. $345.4. 4.57%

- Cayman Islands. $323.8. 4.28%

What are the consequences of the US debt?

The U.S. national debt has soared to historic levels relative to the size of the U.S. economy. Many economists say that a rapidly mounting debt load could soon diminish U.S. economic growth, restrict government spending on important programs, and raise the likelihood of financial crises.

Key Takeaways. Carrying student debt can affect your ability to buy a home if your debt-to-income ratio is too high. If you have too much student loan debt, you won't be able to save as much for retirement. Student loan debt can lower your credit score, especially if you fail to make on-time payments.

The main disadvantage of debt financing is that interest must be paid to lenders, which means that the amount paid will exceed the amount borrowed.

Bad debt is when money is used to buy a depreciating asset or something that does not generate income. Furniture, clothing, holidays, weddings and the latest gaming console are examples of things that would be bad debt. Buying the latest high spec car is bad debt.

- Brunei. 3.2%

- Afghanistan. 7.8%

- Kuwait. 11.5%

- Democratic Republic of Congo. 15.2%

- Eswatini. 15.5%

- Palestine. 16.4%

- Russia. 17.8%